Frequently Asked Questions

General Questions

What is your Routing Number?

Our Routing Number: 296076262

If you are setting up a Direct Deposit to your Ideal CU account, you will need our Routing Number.

Download the Direct Deposit Form

Does Ideal CU have safe deposit boxes?

Yes, Ideal CU has safe deposit boxes available for rent at our Eagan, Hugo, North St. Paul and Woodbury locations. Safe deposit box sizes and prices are as follows:

2 x 5 x 21" = $35

3 x 5 x 21" = $40

3 x 10 x 21" = $75

5 x 10 x 21" = $95

10 x 10 x 21" = $135

Drilling of lock = $250

Lost key = $45

Safe Deposit Box Fees are an annual cost. Sizes and availability of boxes may vary by location. Call 651-770-7000 or 800-247-0857 for more information.

Why should I use Ideal Credit Union?

If you’re looking for exceptional service, quality financial solutions and people who go beyond the ordinary to meet your needs, you’ve come to the right place. At Ideal CU we put members first and look for ways to say “yes.”

Who can join Ideal CU?

Anyone who lives, works, worships, attends schools or volunteers in Anoka, Chisago, Dakota, Hennepin, Ramsey or Washington counties is eligible. Those outside the six-county area are eligible by making a $5 donation to the John Miller Scholarship program. Additional eligibility information can be found on the Membership Eligibility page.

What does Ideal CU offer?

Ideal CU offers a full line of quality financial products and services. What sets us apart is our commitment to personalized service above and beyond your expectations. Ideal CU strives to make every experience a positive one and values the trust you place in us to be your financial partner.

Digital Banking & Mobile App Questions

What do I do if I forgot my password?

Go to Ideal Credit Union's Homepage and click the “Forgot Password” on the login box under where you put your credentials. On the next page you will need to agree to a brief disclosure. Click agree to continue and answer a few validation questions. You will then be asked how you would prefer your temporary password to be delivered (select either text or email). Once you receive your temporary password, continue through the process to reset your password.

What do I do if I forgot my username?

Go to Ideal Credit Union's Homepage and click the “Forgot Username” on the login box under where you put your credentials. On the next page you will need to answer a few validation questions. After you validate your credentials, continue to follow the on-screen instructions.

My account is disabled. What do I do?

If your account becomes disabled due to too many incorrect login attempts, go to Ideal Credit Union's Homepage and click the “Forgot Username” on the login box under where you put your credentials. Follow the on-screen instructions to recover your account.

Business Digital Banking Questions

Who should I contact with questions regarding enrollment and set up?

A representative will need to assist you with setting up your business digital banking account. Contact Business Services at 651-747-8900, email

Mobile Check Deposit Questions

What is Mobile Check Deposit (MCD)?

MCD is a free service that allows you to deposit checks into your eligible Ideal CU deposit account(s) electronically using the camera on your Apple or Android device.

What if I don't have Mobile Banking?

It's simple to get started. Download the app from the App Store (iPhone) or Google Play (Android). Search for “Ideal CU Mobile Banking.” Follow the on-screen instructions to gain access to your Ideal account using the mobile app.

What devices are compatible with MCD?

Currently, both Apple and Android devices are compatible with MCD.

Is MCD a free service?

MCD is a free service provided you by Ideal CU. However, usage rates from your mobile carrier may apply when using Mobile Banking. Make sure you understand the terms of your mobile agreement before using the app.

How do I access MCD?

Access MCD within the Ideal Mobile Banking App.

Who can use MCD?

To be eligible to use Mobile Check Deposit you must have downloaded the latest version of the Ideal Mobile Banking App and:

- Have an Apple or Android device.

- Download the most recent version of the Ideal CU Mobile Banking App.

- Have an active Ideal CU eligible deposit account.

- Be enrolled in Ideal CU Digital Banking.

- List your current email address within Digital Banking.

- Be in good standing with Ideal CU.

If you attempt to use MCD and receive a message instructing you to contact the credit union, you may be ineligible. Please call 651-770-7000 or email us at

Can Business accounts use MCD?

Yes, MCD is available for eligible Ideal Business accounts.

How do I endorse a check submitted using MCD?

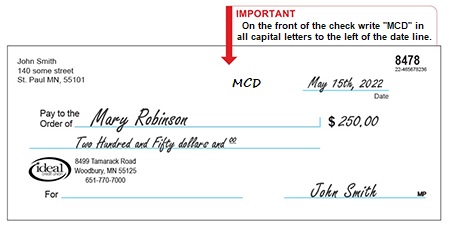

On the front of the check

- Write "MCD" to the left of the date line in all capital letters.

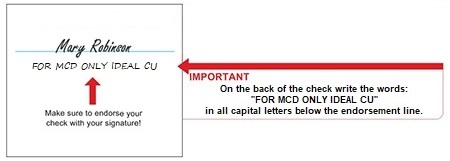

On the back of the check

- Write "FOR MCD ONLY IDEAL CU" in all capital letters below your endorsement line.

- Endorse the check with your signature.

What types of checks does MCD accept?

Acceptable check types made payable to you and/or joint owners include personal checks, business checks, or cashiers checks drawn on a financial institution located within the U.S.

What types of checks does MCD NOT accept?

- Foreign Checks/Foreign Currency

- Savings Bonds

- Altered checks

- Second party checks

- Stale-dated checks (date issued extends six or more months prior to the date of deposit)

- Post-dated checks (date issued is a future date from the date of deposit)

- Checks made out incompletely or incorrectly

- Non-negotiable items

- Damaged checks

- Non-legible checks

How do I take a picture of the check?

To take a picture of your check, place it on a flat, non-shiny surface. Make sure your environment is brightly lit and your check is not under direct sunlight. Hold the camera directly over the check and use the borders to properly zoom and scale until the check is in full view.

NOTE: The picture should only include the image of the check. (Make sure other checks, books, keys, change or shiny items are not in the picture. Reflections, glare and blurring may also result in your deposit being rejected).

Is there a limit on how much I can deposit?

You can deposit up to $2,500 daily into eligible Ideal CU deposit accounts. You can apply to increase your daily limits by contacting the credit union at 651-770-7000 or 800-247-0857.

Can I deposit more than one check at a time?

Yes, multiple check items can be deposited in one session as long as they do not exceed the daily deposit limit.

How do I verify that a check has been accepted?

You will receive an on-screen confirmation immediately after submitting your check deposit. This only confirms that you have submitted a deposit and does not guarantee availability of funds in your account. All MCD deposits are subject to physical review and deposits may be adjusted or rejected based on the check’s content and accuracy. All deposits must meet our deposit criteria.

What do I do if I get an image error message?

Retake the picture as directed.

Will my check deposit be available immediately for use?

Deposited funds will typically be available by the following times:

- Deposits made before 3:30 p.m. (CST) Mon - Fri will be posted to your account by 6:00 p.m. that same day.

- Deposits made after 3:30 p.m. (CST) Mon- Fri will be posted to your account the next business day.

- Deposits made on weekends or holidays will be posted to your account the next business day.

If I entered an incorrect amount for a deposited check, should I re-deposit the check?

No. A check can only be deposited into MCD once. Entries with an incorrect check amount will be reviewed, adjusted and credited for the correct amount of the check. However, if you see a discrepancy in the deposit posted, please contact Ideal CU at 651-770-7000 or 800-247-0857.

Why is a deposit I made still not showing in my available funds?

Your deposit may be subject to a hold. Some checks may be subject to a hold (see our Funds Availability Policy).

Your deposit may have been rejected. Deposits may be rejected for several reasons. Review the following common reasons deposits are rejected:

- Incorrect endorsement (see MCD Endorsement Guidelines).

- Payee or payees not present on deposit account: All payees listed on your check must be an owner or joint owner of the deposit account.

- Check is stale/post-dated: Make sure the check you are depositing includes the date the check was issued. Your check is stale-dated and will be rejected if the date issued extends six or more months prior to the date of deposit. If this occurs you will need to request a new check be issued to you. Your check is post-dated and will be rejected if the date issued is a future date from the date of deposit.

An Ideal Representative will email you if your deposit is rejected.

Your deposit may still be pending. Deposited funds will typically be available by the following times:

- Deposits made before 3:30 p.m. (CST) Mon - Fri will be posted to your account by 6:00 p.m. that same day.

- Deposits made after 3:30 p.m. (CST) Mon- Fri will be posted to your account the next business day.

- Deposits made on weekends or holidays will be posted to your account the next business day.

Please retain your deposited check for 14 days before securely disposing it.

What should I do with my check after using MCD?

Retain your check for 14 days after it has cleared your account. After 14 days, it is a best practice to shred the check. DO NOT mail the check to Ideal CU. (We suggest after depositing a check, put a note on the front corner of the check with the date and MCD, to prevent accidentally trying to deposit the check more than once.)

How long can I view my transaction history?

Uploaded deposit information can be viewed the Mobile Banking app for 90 days, and all approved deposits will in Online and Mobile Banking transactions history.