Mobile Check Deposit FAQ

Getting started

What is Mobile Check Deposit (MCD)?

MCD is a free service that allows you to deposit checks into your eligible Ideal CU deposit account(s) electronically using the camera on your iPhone, iPad, or Android device.

What if I haven’t used Mobile Banking?

Download the app from the App Store (iPhone) or Google Play (Android). Search for “Ideal CU Mobile Banking.”

What devices are compatible with MCD?

Only iPhone, iPad and Android devices are compatible with MCD.

What if I’m not able to log in to Mobile Banking?

Use your Ideal CU Online Banking credentials to sign in. If you have not enrolled in Online Banking yet, enroll now to establish your credentials.

Will MCD benefit me?

Yes! MCD allows you to save time, money, and gas by safely depositing checks into your eligible deposit account(s) anytime, anywhere with your compatible smart phone or tablet.

Is there a cost to use MCD?

MCD is a free service provided you by Ideal CU. However, usage rates from your mobile carrier may apply when using Mobile Banking. Make sure you understand the terms of your mobile agreement before using the app.

How do I access MCD?

Access MCD within the Ideal CU Mobile Banking App.

Who can use MCD?

To be eligible to use Mobile Check Deposit you must have downloaded the latest version of the Ideal CU Mobile Banking App and:

- Have an iPhone, iPad or Android device.

- Download the most recent version of the Ideal CU Mobile Banking App.

- Have an active Ideal CU eligible deposit account.

- Be enrolled in Ideal CU Online Banking.

- List your current email address within Online Banking.

- Be in good standing with Ideal CU.

If you attempt to use MCD and receive a message instructing you to contact the credit union, you may be ineligible. Please call 651-770-7000 or email us at

Can Business accounts use MCD?

Yes, MCD is available for eligible Ideal Business accounts.

Can I use MCD to deposit funds to any Ideal CU account?

You can only deposit checks into your own eligible deposit account(s); this includes savings and checking accounts.

NOTE: Checks written written from one of your Ideal CU accounts to another Ideal CU account of which you are the owner will not be accepted. To transfer funds between your separate Ideal CU accounts, log in to Ideal CU Online Banking, select the "User Services" tab and click "Add New Online Account." Once you finish adding your other Ideal CU accounts you will be able to make transfers via Online Banking.

Can I use MCD on more than one account that I have at Ideal CU?

Each eligible deposit account from your online banking profile will be included as an option to deposit funds when using MCD. Log in to Ideal CU Online Banking and select the "User Services" tab to request access to an Ideal CU deposit account. Once approved, this account will show up as an eligible account to deposit funds via MCD.

Making a mobile check deposit

How do I endorse a check submitted using MCD?

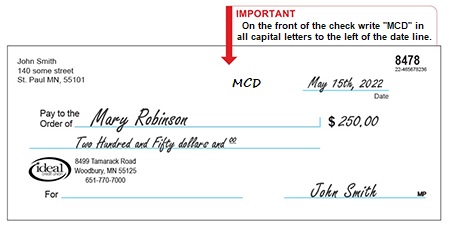

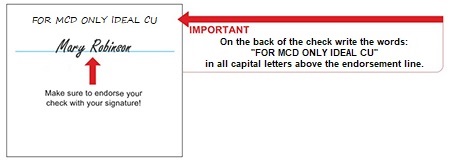

On the front of the check

- Write "MCD" to the left of the date line in all capital letters.

On the back of the check

- Write "FOR MCD ONLY IDEAL CU" in all capital letters above your endorsement line.

- Endorse the check with your signature.

Any checks submitted that do not meet these requirements may be rejected. Funds are typically available in 1-2 business days. Check deposits may be subject to further hold according to our Funds Availability Policy. You will be notified via the email address you provided in Online Banking if longer holds will apply.

What types of checks does MCD accept?

Acceptable check types made payable to you and/or joint owners include personal checks, business checks, or cashier's checks drawn on a financial institution located within the U.S.

What types of checks does MCD NOT accept?

- Foreign Checks/Foreign Currency

- Savings Bonds

- Altered checks

- Second party checks

- Stale-dated checks (date issued extends six or more months prior to the date of deposit)

- Post-dated checks (date issued is a future date from the date of deposit)

- Checks made out incompletely or incorrectly

- Non-negotiable items

- Damaged checks

- Non-legible checks

How do I take a picture of the check?

To take a picture of your check, place it on a flat, non-shiny surface. Make sure your environment is brightly lit and your check is not under direct sunlight. Hold the camera directly over the check and use the borders to properly zoom and scale until the check is in full view.

To take a picture of your check, place it on a flat, non-shiny surface. Make sure your environment is brightly lit and your check is not under direct sunlight. Hold the camera directly over the check and use the borders to properly zoom and scale until the check is in full view.

NOTE: The picture should only include the image of the check. (Make sure other checks, books, keys, change or shiny items are not in the picture. Reflections, glare and blurring may also result in your deposit being rejected).

Is there a limit on how much I can deposit?

You can deposit up to $3,500 weekly into eligible Ideal CU deposit accounts. You can apply to increase your daily limits by contacting the credit union at 651-770-7000 or 800-247-0857.

Can I deposit more than one check at a time?

Yes, multiple check items can be deposited in one session as long as they do not exceed the daily deposit limit.

How do I verify that a check has been accepted?

You will receive an on-screen confirmation immediately after submitting your check deposit. This only confirms that you have submitted a deposit and does not guarantee availability of funds in your account. All MCD deposits are subject to physical review and deposits may be adjusted or rejected based on the check’s content and accuracy. All deposits must meet our deposit criteria.

What do I do if I get an image error message?

Retake the picture as directed.

After making a Mobile Check Deposit

Will my check deposit be available immediately for use?

Deposited funds will typically be available by the following times:

- Deposits made before 3:30 p.m. (CST) Mon - Fri will be posted to your account by 6:00 p.m. that same day.

- Deposits made after 3:30 p.m. (CST) Mon- Fri will be posted to your account the next business day.

- Deposits made on weekends or holidays will be posted to your account the next business day.

If I entered an incorrect amount for a deposited check, should I re-deposit the check?

No. A check can only be deposited into MCD once. Entries with an incorrect check amount will be reviewed, adjusted and credited for the correct amount of the check. However, if you see a discrepancy in the deposit posted, please contact Ideal CU at 651-770-7000 or 800-247-0857.

Why is a deposit I made still not showing in my available funds?

Your deposit may be subject to a hold

Some checks may be subject to a hold (see our Funds Availability Policy).

Your deposit may have been rejected

Deposits may be rejected for several reasons. Review the following common reasons deposits are rejected:

- Incorrect endorsement (see MCD Endorsement Guidelines).

- Payee or payees not present on deposit account: All payees listed on your check must be an owner or joint owner of the deposit account.

- Check is stale/post-dated: Make sure the check you are depositing includes the date the check was issued. Your check is stale-dated and will be rejected if the date issued extends six or more months prior to the date of deposit. If this occurs you will need to request a new check be issued to you. Your check is post-dated and will be rejected if the date issued is a future date from the date of deposit.

An Ideal CU representative will email you if your deposit is rejected.

Your deposit may still be pending

Deposited funds will typically be available by the following times:

- Deposits made before 3:30 p.m. (CST) Mon - Fri will be posted to your account by 6:00 p.m. that same day.

- Deposits made after 3:30 p.m. (CST) Mon- Fri will be posted to your account the next business day.

- Deposits made on weekends or holidays will be posted to your account the next business day.

Please retain your deposited check for 14 days before securely disposing it.

What should I do with my check after using MCD?

Retain your check for 14 days after it has cleared your account. After 14 days, it is a best practice to shred the check. DO NOT mail the check to Ideal CU. (We suggest after depositing a check, put a note on the front corner of the check with the date and MCD, to prevent accidentally trying to deposit the check more than once.)

How long can I view my transaction history?

Uploaded deposit information can be viewed the Mobile Banking app for 90 days, and all approved deposits will in Online and Mobile Banking transactions history.

If I use both Internet Banking and Mobile Banking, will I see my transaction history reflected in both places?

Yes.